How to Organize Household Finance After the presence of the Son

The presence of children is an important moment in the family . Moreover , in addition to happiness , the presence of the baby has little implication finances . Need to manage finances different household after the baby 's presence .

When my son was born , we did a lot of preparation , my wife and , since far - away days . Starting from regular visits to the doctor , choosing a hospital to give birth , buying baby gear to look for a baby sitter .

Understandably , the presence of the baby has been expected for a long time , so we went through the exciting process . All the preparation that we consider important are already trying to do .

However , there are things that are actually important , but unnoticed . What is it ? We did not properly manage the family finances while welcoming the presence of the child. How to set up household finances is still the same as when no children .

Maybe because we do not know , but probably also because of ignorant , thinks it's not important .

Consequently ?

In the first month of birth , our finances collapsed . Previously , we could set aside a regular investment . in it , not just routine investments that fail , even spending is greater than expenditure .

In the first month of birth , our finances collapsed . Previously , we could set aside a regular investment . in it , not just routine investments that fail , even spending is greater than expenditure .

Financial minus . We had to melt deposits .

Initially , I thought it only momentarily because of the needs of the symptoms in the beginning . In fact do not .

This condition persisted for 6 months straight - can participate without brakes.

Finally , in order to stop the financial bleeding , I decided to look back and analyze all expenditures . Spending a month I noted every day .

After analysis , the main problem ketemulah number , namely :

A surge in spending . Spending rose nearly 2-fold . Costs - costs that have nothing , appear in large numbers . For example , salaries baby sitter , baby food and beverage expenses , as well as clothing . Additional costs for the benefit of future children are also small . There are educational investments and insurance . It all makes the accumulated expenditures increased many times . I know that spending will go up , but it is not anticipated that this high Ascension .

Our expenditure pattern has not changed . My wife and still had the same consumption patterns as not to have children . Snack at the same place , the same style of shopping at weekends and others - others .

As a result it's obvious , is not it? With our salary is still the same , while there was a surge in spending due to the child's needs while the old spending patterns do not change , it is not surprising , household finances into deficit each month .

After this incident plus a number of references that I see , the conclusion that the way family finances are different .

Manage finances when no children can no longer be applied . Need to apply different ways .

Children's and Household Finance

What needs to be prepared in the presence of a child ?

This is important . After seeing what the financial consequences , you can make a new financial management strategy is right on target .

I met a lot of friends who do not know , what are the financial consequences of the presence of additional family members at home . Even know , just a piece - a piece , not comprehensive .

No wonder the preparation of the financial side so chaotic - turvy .

I noted a number of things that need to be anticipated :

1 . Increased Spending

Appeared many additional costs that had been non-existent, such as food and clothing children , the presence of a maid or baby sitter and others - others , which affect household spending .

Moreover , the excited children, the first child again , make parents want to always give the best . The problem is , it's the best , cheap rare , usually expensive. Ends , the monthly expenditure so not guess - guess .

The challenge is to determine how the bulls are still reasonable . Can be very subjective . Because individual consumption patterns - each parent is different - different , so is the ability of the financial support the additional expenditure .

2 . Investing Education

The cost of children's education is a thing to be prepared far - away days . There is an additional allocation of monthly spending for education investment needs . To that end , a number of steps need to be done .

Determine how much funding education . Do a survey of school fees ranging from kindergarten , elementary , junior high , high school and even university . Then , determine the forecast increase in costs per year . From here you can calculate the estimated total cost for each - each level .

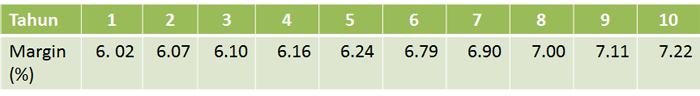

Choosing a financial instrument to achieve targets of education funding . Choose an instrument that provides a level of profit that can achieve these targets .

If it is still heavy set aside funds for education , needs to be made a priority . My advice start of the closest , eg entering kindergarten or elementary school needs . It is most urgent .

However , other levels of education needs should not be forgotten . Principally because the longer we prepare , the more light that funds should be set aside .

The key lies in the selection of appropriate investment instruments . For the long term , over 5 years , I suggest putting in stock mutual funds . Meanwhile , short-term goals can be in gold , mutual funds or money market mutual funds mixture .

In essence , given the return can offset the increase in costs each year . What about education savings ? I do not really recommend , refer to the explanation here .

3 . Adding to an Emergency Fund

Have a child means a great responsibility as a parent . If there is something unpleasant , as much as possible the impact on children , especially things that are essential , such as education and health , minimum . One way is to have an emergency fund .

If before having children , emergency funds may not be a priority . Now with dependents , emergency fund becomes mandatory component .

Is not there insurance ? Different purpose .

These funds are used to things - things that are not covered by insurance protection . For example , job loss or decreased income . If you have prepared investment slumped , so that there are not enough funds , emergency funds can be used as an emergency fund .

For example , in 2008 , the market fell , the stock price dropped to the bottom . In this situation , an emergency fund can save your finances as it is placed in a relatively safe instruments . Later after the stock market rebounded , you can reverse the emergency funds previously withdrawn .

The number of emergency funds recommended for families with one child is 6 to 9 times the monthly expenditure . For example , expenditures ( after having children ) to Rp 10 million , then an emergency fund of at least USD 60 million .

More and more members of the family , the greater the expenditure , the allocation of emergency funds should be higher.

Emergency funds were placed in liquid financial instruments and risk is small . The goal is not looking for profit , but rather the level of security and ease of access .

The instrument can be selected for emergency funds include deposits , savings plan with interest on regular savings , gold or money market mutual funds .

For those who have not had this before allocation , fund demand for it usually feels burdensome . My advice , though it may not yet be on target , the most important is to start . Slowly - slowly over the ability of the household finances improved , later increased in number .

3 . Buying Life Insurance

Having no children , ownership of life insurance becomes mandatory . Why ? It forms the responsibility of parents to children . If a parent dies , the child has financial protection . Insurance fund that will provide insurance coverage for the child's life .

It should be carefully taken into account how the value of life insurance coverage is adequate . Ideally , the insurance protection sufficient funds to finance a child's life into adulthood .

Protection needs to be juxtaposed with the ability to pay premiums . The greater the coverage, the greater the premium to be paid .

Strive to choose insurance that is consistent with financial objectives . Because the goal is protection , to optimize the amount of the sum assured . Make sure the number is sufficient .

One type that could be considered is a term- life insurance or pure insurance protection because it provides optimal value with a relatively affordable premiums .

How to Organize Household Finance

From the description above , the consequences are obvious , ie the increase in spending . Many of the costs and the allocation of investment in order to support the baby's life . Meanwhile , on the other hand , we know the income or salary is not necessarily rise . Even if rising , bulls conducted once a year and at the end of the year .

How to set family financial tips in a situation like this ?

1 . Making Priorities and Budget Spending

Under conditions of limited resources , priority is making steps that need to be done . Establish which one should come first , which should be delayed or even not done at all .

However , more importantly , when making a priority , you are indirectly forced to perform an evaluation of family expenditure patterns . Which of these evaluations may not have ever done before.

Steps to set priorities and household budgets are as follows :

First , calculate the expenses in one month . Record all expenses within a month , the more detailed the better , do not fall through the cracks .

My experience , a lot of expenses that the numbers are small - so small we often ignore unmonitored . In fact , this seemingly small expenses add up to a large amount in a month .

Just one month record , but cultivated as completely as possible . So you can picture kumplit and clear .

As a result, the entire monthly expenses unraveled so plain that you know where that is not important but costly , which can be saved and others - others .

For example , when doing this , I came to know that the money for coffee and a snack , which seems small when viewed every day , in fact, spend a small amount in a month .

Many of the insights here about the pattern you consume and how lifestyle living. Generally , we have never done an evaluation of the expenditure , everything is automated , especially on matters relating to children . Not aware that spending has been out of control .

You will be surprised to see the results .

Secondly , based on the record spending , set priorities and budgets for each set - each tailored to spending our financial capabilities . Decide where we want to precedence , which is not too important .

The key , priorities and budgets must be prepared and decided together in the family . Everything has to be agreed . By doing so , appears committed to run it .

Parents often emotional , especially the first time to have children . Because of this assumption for the child , no matter what the cost could be justified . Facing this kind of emotional challenges , priorities and budget into a tool of control is quite effective in my experience .

2 . Managing Spending Wisely

Lugasnya language , you have to downsize . Can be done in various ways . Ranging from easy to difficult .

First , reduce your expenses and your partner . Starting from the most consumptive and unimportant . Use records to see which consumer spending that could be reduced or even eliminated .

My observation , saving food and clothing smelling life - style most significant . For example , a weekend road to be reduced from the usual mall every week to two or three weeks once . Coffee that had been saved by the famous coffee shop to make your own coffee at work or looking for a cheaper place .

If it is the intention , there is usually only path.

Importantly , subtract the first consumption life - style . Because you do not make a big impact and is generally not important because it is more for pleasure purposes .

As much as possible do not reduce essential spending , such as investment and saving . If the investment to be reduced , while the consumption life - style left , the negative impact for your life in the future .

I met many people who first cut investment , while spending life style is maintained. Not a wise choice in managing household finances .

Second , provide the needs of children according to ability . There are many alternatives in the market quality and price . Importantly , be of the highest quality ( high price ) . But that is not important should select a more affordable price .

Do not be easily carried away . Many things - things that can actually be saved .

Take an example . Under the age of five , children grow so fast , so easy to change clothes . What needs to be high-priced clothing ? It may be necessary but not necessarily all of them . If there are clothes of an older child who still deserve to wear , can be handed over to his brother .

So it is with toys . Should it be the exorbitant price and quality ? Now there are those who rent toys - children . This business was born out of the fact that children - children get bored with his toys .

In his book , " Make It Happen " , a financial planner Ghozie Pritchard , presenting interesting facts . According to him , Mother's Milk ( ASI ) is not only good in health , but also good for the family finances .

In the book, Pritchard shows the count of numbers - numbers , how breastfeeding can save more than formula feeding ( bottle-feeding ) . It inspired frugality , interesting and worthy to be considered in the management of the family finances .

0 comments:

Post a Comment